Introducing: Insurance Technology INC

Insurance Technology INC is a software as a service company focused on creating solutions for insurance agents to help them grow their business, increase revenue and leverage their time.

The current offerings are Review My Insurance Agent (“RMIA”) and Insurance AI (“IAI”). Both platforms will complement each other to give our clients a well-rounded experience and growth strategy.

ReviewMyInsuranceAgent.com

ReviewMyInsurancAgent.com (“RMIA”) was built to solve a hole in the marketplace: there is no trusted website where consumers can go and research insurance agents they’re looking to do business with. Real estate agents have Zillow, restaurants have Yelp and contractors have “Angie’s List” - but insurance agents have been forgotten.

RMIA has a free model for now, and will be releasing a premium tier in Q2 of 2023.

Insurance Agents can sign up for the free plan and get a landing page, emails they can send to their clients, and their own “badge” they can embed on existing web sites so their prospects can view their reviews. All insurance agents on the website have opted in, and completed the registration on their own.

RMIA will generate revenue by offering:

Premium tier of access ($9.95/mo)

Affiliate marketing revenue (one-time and recurring revenue, depending on offer)

Paid workshops offered by well-known coaches and trainers

Advertising opportunities for businesses that want to work with insurance agents

RMIA is building the biggest, most engaged database of insurance agents in the market. This data set is extremely valuable and will offer numerous opportunities for monetization. There are no competitors that have tapped the market of setting up a Reviews platform for insurance agents.

There are 900,000+ insurance agents that are licensed in the United States, and there are no competitors for RMIA yet. We are first to the market and moving fast!

The initial build and marketing of RMIA is currently financed in full by the founder, Alex Branning. The total amount of expenditure is roughly $25,000.

The website is live and attracting agents to the free plan.

Next Stage of Development for RMIA:

The second phase of RMIA will include the build-out of a free resource center. Inside this resource center we’ll include free tools and include a list of tools and trainings that will include affiliate rewards if our agents purchase the offerings.

Include a video on their landing page

Get a custom QR code that they can include on business cards, merchandise and more

Share a short biography about themselves

Resource Center is “unlocked” with more courses

Our goal is to launch the premium tier of RMIA in Q2 of 2023.

We are currently promoting Agent CRM to our users and getting a 5% conversion rate.

The first paid workshop will be held in July or August 2023.

Ads will be offered in Q3 of 2023.

Financial Projections for RMIA (Base Case and Downside Case)

RMIA will be able to build out multiple revenue streams, including:

Premium tier of access ($9.95/mo)

Affiliate marketing revenue (one-time and recurring revenue, depending on offer)

Paid workshops offered by well-known coaches and trainers

Advertising opportunities for businesses that want to work with insurance agents

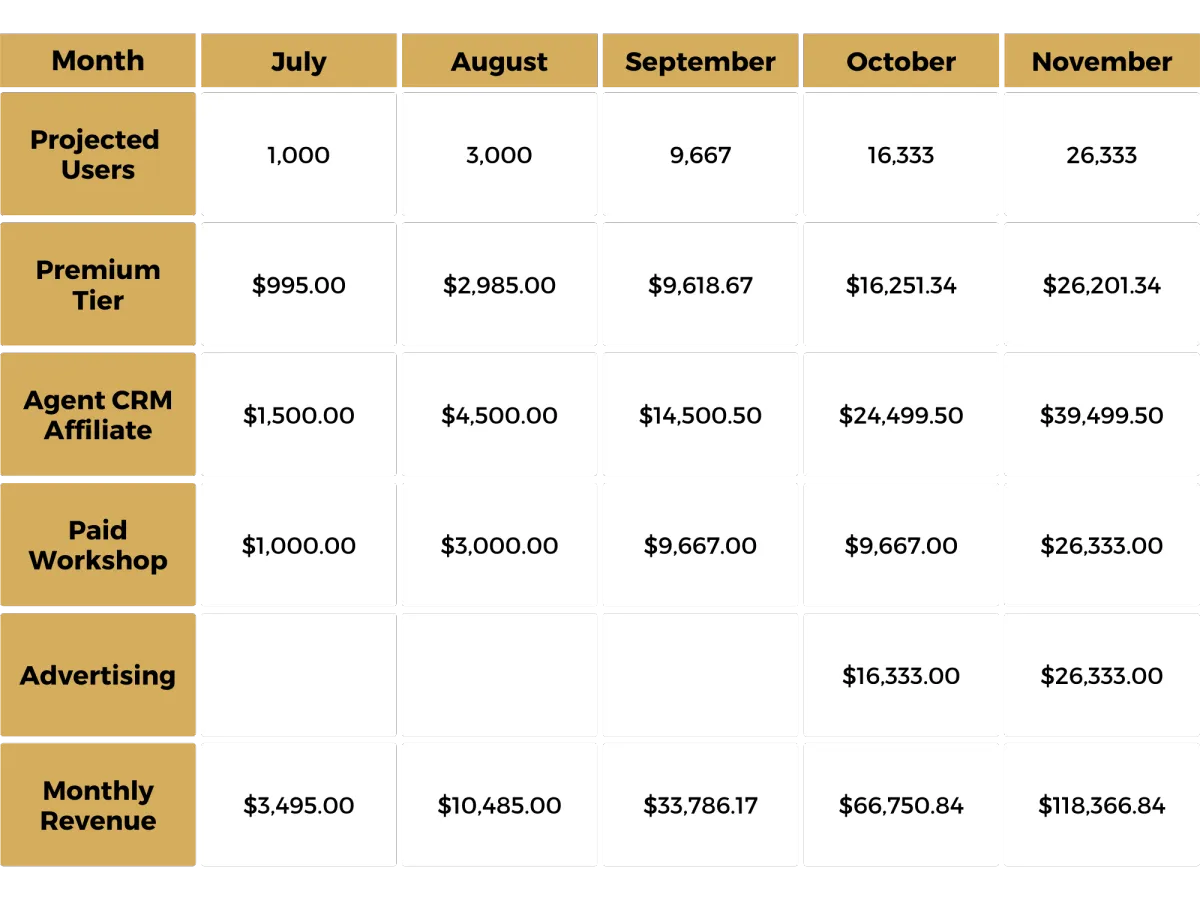

We predict the following profitability outcomes (Base Case):

10% of our user base will upgrade to the premium tier of RMIA ($9.95/mo)

5% of our user base will sign up for Agent CRM ($30.00/mo affiliate revenue)

5% of our user base will sign up for a paid workshop ($20.00 per ticket)

We can charge $1.00/mo/agent for advertising opportunities (banner ads, emails)

The following chart shows the revenue metrics based on Insurance Agent users.

This chart does not include the following revenue streams that we can offer:

– Other affiliate offers for paid courses and software

– “Done For You” service offerings to help agents collect reviews

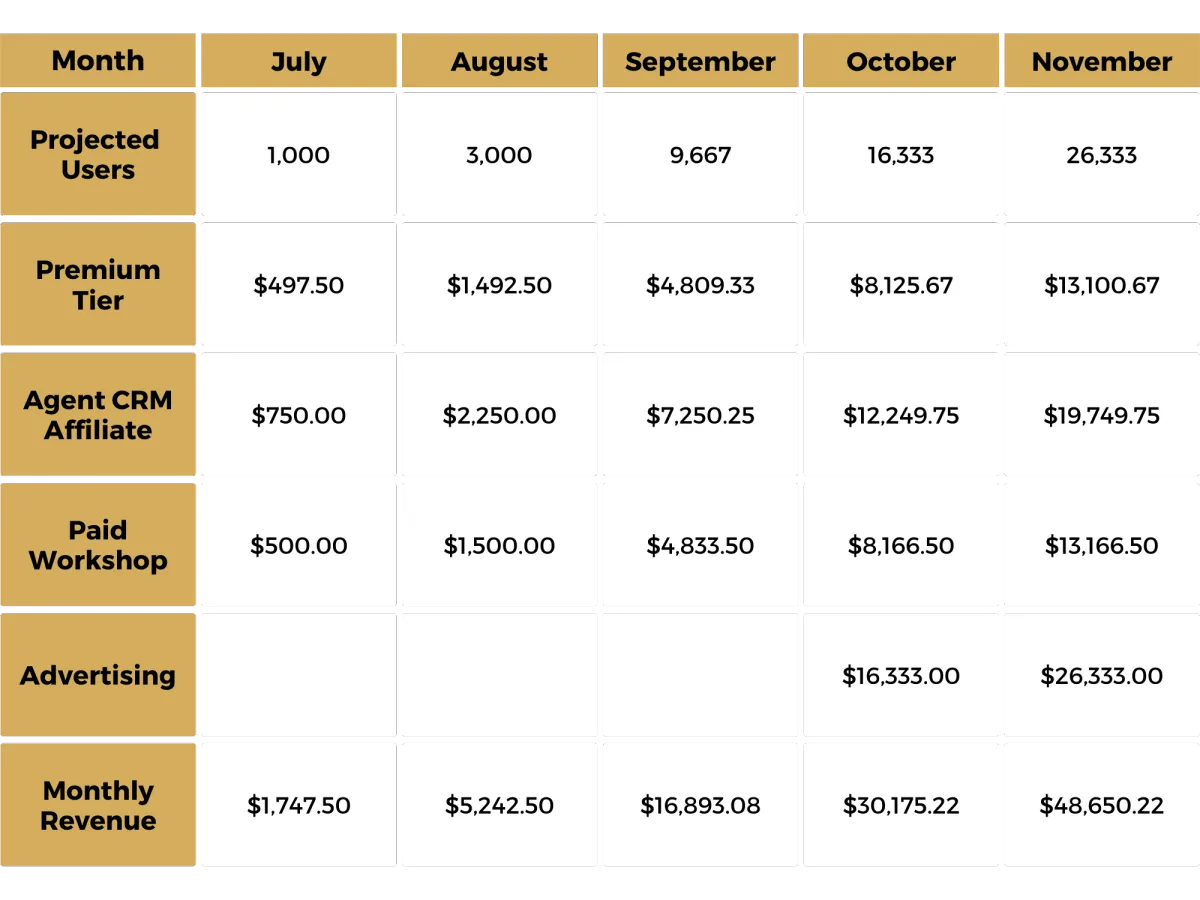

We also mapped out revenue projections with Downside Case performance:

5% of our user base will upgrade to the premium tier of RMIA ($9.95/mo)

2.5% of our user base will sign up for Agent CRM ($30.00/mo affiliate revenue)

2.5% of our user base will sign up for a paid workshop ($20.00 per ticket)

We charge $0.10/mo/agent for advertising opportunities (banner ads, emails)

InsuranceAI (“IAI”) was built for insurance agents and integrates with the most popular insurance marketing platforms to deliver leading marketing campaigns. Using artificial intelligence, the system is designed to deliver top quality individualized campaigns and can assist with tasks from composing personalized emails to constructing high performing ads. IAI serves to unlock insurance agent’s potential and take their marketing to the next level.

Insurance agents can sign up for a free account and get access to some of our “basic” recipes.

InsuranceAI will generate revenue by offering:

Premium tier of access for individual agents ($17.00/mo)

In the first 90 days of launch, we will offer annual plans at $199, if that offer sells we will keep it but the purpose is to drive revenue

Affiliate marketing revenue (one-time and recurring revenue, depending on offer)

White label partnerships with agencies and offices (high ticket item)

Advertising opportunities for businesses that want to work with insurance agents

RMIA is building the biggest, most engaged database of insurance agents in the market. This data set is extremely valuable and will offer numerous opportunities for monetization. There are no competitors that have tapped the market of setting up a Reviews platform for insurance agents.

There are 900,000+ insurance agents that are licensed in the United States, and there are no competitors for RMIA yet. We are first to the market and moving fast!

The initial build and marketing of RMIA is currently financed in full by the founder, Alex Branning. The total amount of expenditure is roughly $25,000.

The website is live and attracting agents to the free plan.

Next Stage of Development for InsuranceAI:

The second phase of InsuranceAI will include the build-out of the paid tier, and offering white-label setup to our users (with a one-time setup fee and a split of the incoming revenue).

We will also be looking to offer an “embedded insurance” offering, where our agents can embed an insurance quote form on other websites that they have relationships with.

Other ideas include a Chrome extension that can be used to help answer emails, and an AI-powered web chat solution for insurance agents to use on their websites.

Our goal is to launch the premium tier of InsuranceAI in Q2 of 2023.

Ads will be offered in Q3 of 2023.

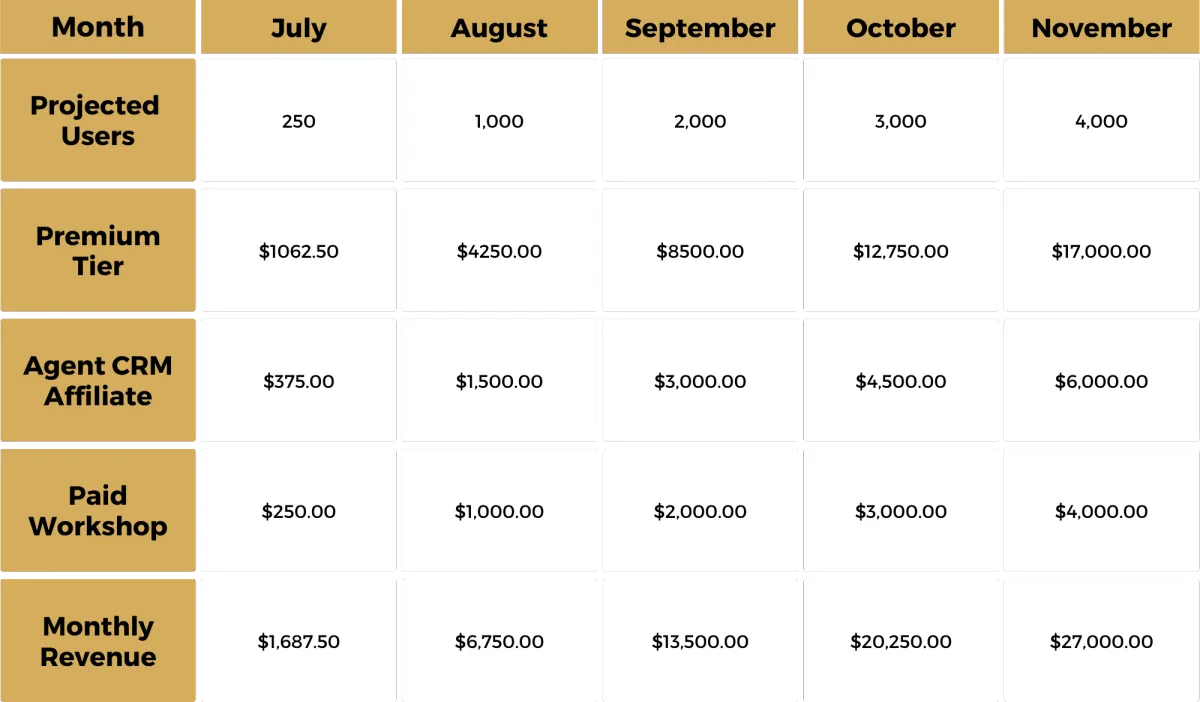

Financial Projections for InsuranceAI

We predict the following profitability outcomes (Base Case):

25% of our user base will upgrade to the premium tier of InsuranceAI ($17.00/mo)

5% of our user base will sign up for Agent CRM ($30.00/mo affiliate revenue)

5% of our user base will sign up for a paid workshop ($20.00 per ticket)

We also mapped out revenue projections with Downside Case performance:

5% of our user base will upgrade to the premium tier of RMIA ($9.95/mo)

2.5% of our user base will sign up for Agent CRM ($30.00/mo affiliate revenue)

2.5% of our user base will sign up for a paid workshop ($20.00 per ticket)

Seed Round

Our initial seed round values the company and its assets at an enterprise value of $2,500,000, and we’re raising $500,000 to expedite the development of the premium features, hire a remote operations team and increase marketing efforts.

We anticipate that Insurance Technology, Inc will break-even in Q4 of 2023. The goal is to exit or recapitalize Insurance Technology, Inc at a $15,000,000 valuation in the next five years. Potential future buyers and investors include Integrity Marketing, United Health and other insurance marketing organizations that want access to another revenue steam and our database.

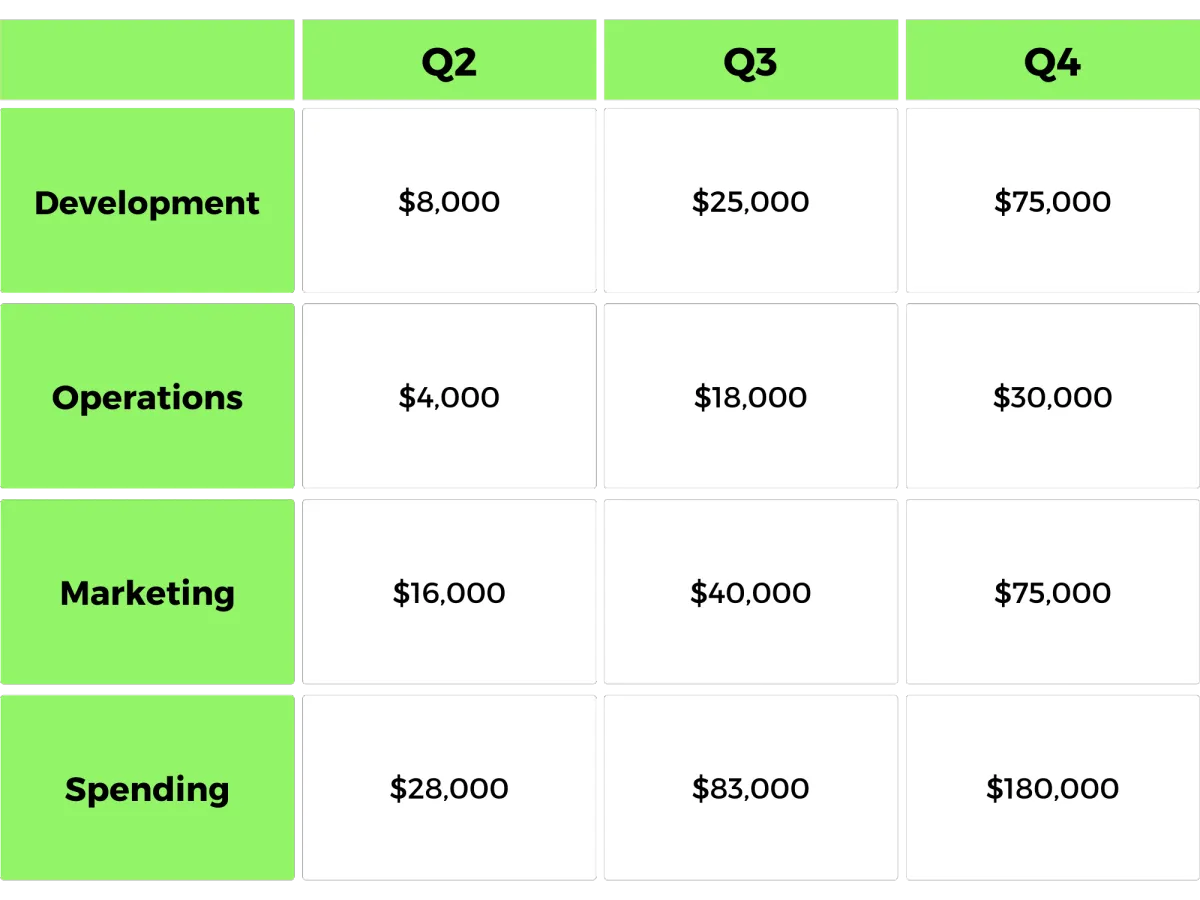

Use of Funds

Operations

May: Hired marketing manager (Chris Murphy) to work on marketing and development roadmap

June: Onboard first internal customer support team member from the 12 Stones Cambodian office

August (if not sooner): Hire sales manager for high ticket sales (advertising, partnerships, etc)

Shareholder Profitability

Starting in Q1 of 2024, I propose a 10% quarterly dividend paid to shareholders.

RMIA will remain a remote-only team, so there will not be office expenses. The team will primarily be made up of contractors (development and customer support) with a minimal team of US-based managers. The majority of our customer support will be handled using artificial intelligence and automated responses.

About the Founder

Alex started the Branning Group in December 2000, when he was only 17 years old. Since then, he has helped thousands of businesses and entrepreneurs and is now widely considered one of the leading high performance marketing coaches in the country. Alex has revolutionized the insurance and real estate marketing sector with his “Giveaway Funnel” strategy, and his trainings have been consumed by entrepreneurs worldwide.

He is followed by tens of thousands of entrepreneurs on Instagram and Facebook, his podcast has been rated as a top business podcast and his YouTube videos have been watched over 200,000 times.

He lives in Manhattan, NY with his wife Kathy, his daughter Ali and their two pets.

Alex is now focusing his energy on 12 Stones, and partnering with entrepreneurs to grow their businesses, impact their communities and create Kingdom-based enterprises that provide for generations to come.